原文标题:我怎么配和首富一起玩比特币

首富埃隆·马斯克,确定的说,是Tesla,投资了(过)15亿美金比特币(Bitcoin),然后市场就疯了,几个小时之内涨了20%,一举突破30万人民币一枚。

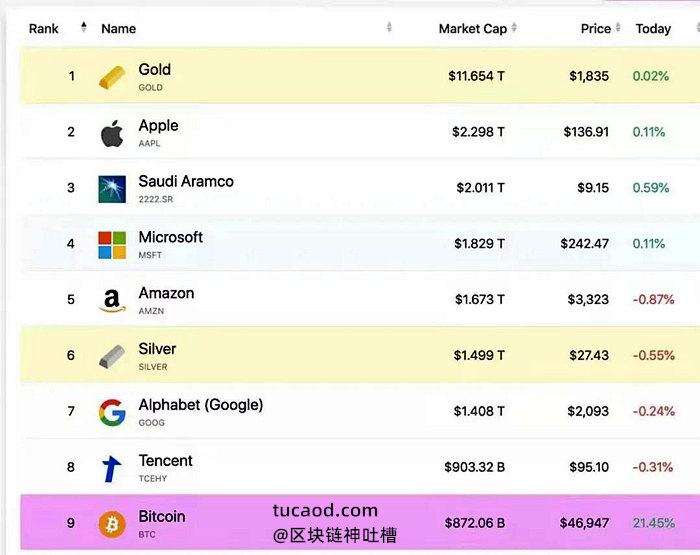

然后Bitcoin一跃而成第九大市值资产。看着比特币这么疯狂,连首富都上(过)船了,哪个人不是心理痒痒的,不禁问,我配和首富一起玩吗?

Tesla在2021年2月8号(对,昨天)向美国证券交易委员会提交的年报10-K中披露投资了(过)15亿美金在比特币,年报中详细说明了投资后面的原委,过程,风险和控制。

要跟还是不跟,配还是不配玩,不能稀里糊涂,一定要清清楚楚,赚要赚得通透,死也要死得明白。

Tesla 特斯拉年报

首先,Tesla于2020年底持有现金及其等价物约193.8亿美元,2021年1月,Tesla将其中15亿美元投入(过)比特币,占所持现金比例7.7%。显然,这点百分比,对Tesla来说,是毛毛雨,而相对8000多亿美元的总市值来说,就更是不痛不痒。我有多少闲钱,能够投入到这种冒险中,这种钱不应该影响正常的生活,更不能借钱去操作,尽管有大发的可能,但如果激进,倾家荡产的概率更大。我需要三思。

接着,Tesla在年报中一共提到了9次比特币,而且每次提到,都一而再,再而三,的强调风险。

第一段提到,是在讨论公司的各种风险的部分,如是说。为了防止断章取义,防止偏离本意,特意辅佐英文原文。

We hold and may acquire digital assets that may be subject to volatile market prices, impairment and unique risks of loss.

我们持有并可能收购数字资产,这些资产可能会受到市场价格波动,减值和独特的亏损风险的影响。

三个概况性的风险:价格波动,减值和亏损。这是任何投资都会遇到的风险。然后,下面具体解释了这些风险。

In January 2021, we updated our investment policy to provide us with more flexibility to further diversify and maximize returns on our cash that is not required to maintain adequate operating liquidity. As part of the policy, which was duly approved by the Audit Committee of our Board of Directors, we may invest a portion of such cash in certain alternative reserve assets including digital assets, gold bullion, gold exchange-traded funds and other assets as specified in the future. Thereafter, we invested an aggregate $1.50 billion in bitcoin under this policy and may acquire and hold digital assets from time to time or long-term. Moreover, we expect to begin accepting bitcoin as a form of payment for our products in the near future, subject to applicable laws and initially on a limited basis, which we may or may not liquidate upon receipt.

2021年1月,我们更新了投资政策,为我们提供了更大的灵活性,以进一步分散和最大化现金的回报,而维持现金充足并不需要这些现金。作为政策的一部分,该政策已得到董事会审计委员会的正式批准,我们可能会将部分现金投资于某些另类储备资产,包括数字资产,金条,黄金交易所买卖基金和指定的其他资产在将来。此后,根据这项政策,我们总共投资了15亿美元的比特币,并可能会不时或长期收购和持有数字资产。此外,我们希望在不久的将来,根据适用法律并在有限的基础上,开始接受比特币作为我们产品的付款方式,在收到付款后我们可能会或可能不会清算。

- Tesla维持现金充足并不需要这些现金,也就是说,这些现金不会影响公司的运营和生存。我如果投入现金,现金会不会影响我的生存?不会,可以玩;会,不能玩。

- “invested”用的是过去式,表示已经完成了操作,而且是一月份的价格,买的。那么,现在是否已经出货了,没有人知道,或者是乘着热度,在慢慢的出货,也无从得知。这其实也是一般散户玩不好的原因,带头大哥,永远不会告诉他什么时候买卖。很可能,就是最后一波韭菜。如果自己不了解,光听,光从众,死的很惨是必然的,玩不起。

- 就算用比特币买Tesla,马上可能清算,这样,和现金买,其实是没有区别的,那这么做,除了引起市场的情绪,哄着玩,还有什么。玩不起呀。

The prices of digital assets have been in the past and may continue to be highly volatile, including as a result of various associated risks and uncertainties. For example, the prevalence of such assets is a relatively recent trend, and their long-term adoption by investors, consumers and businesses is unpredictable. Moreover, their lack of a physical form, their reliance on technology for their creation, existence and transactional validation and their decentralization may subject their integrity to the threat of malicious attacks and technological obsolescence. Finally, the extent to which securities laws or other regulations apply or may apply in the future to such assets is unclear and may change in the future. If we hold digital assets and their values decrease relative to our purchase prices, our financial condition may be harmed.

数字资产的价格在过去和未来可能会继续高度波动,包括各种相关风险和不确定性的结果。例如,此类资产的普及是相对较新的趋势,投资者,消费者和企业对其的长期采用是不可预测的。此外,它们缺乏物理形式,对它们的创建,存在和交易验证以及对技术的依赖以及对权力的分散,可能使其完整性遭受恶意攻击和技术过时的威胁。最后,尚不清楚证券法或其他法规在将来适用于或将来可能适用于此类资产的程度,并且将来可能会发生变化。如果我们持有数字资产,并且其价值相对于我们的购买价格下降,那么我们的财务状况可能会受到损害。

具体的几个风险,我有没有考虑到?

第一,新的趋势,消费者和企业是否长期采用,Tesla都不可预测。我就更不能预测了。

第二,遭受恶意攻击和技术过时的威胁。Tesla都没有信心,我就更茫然了。但是,数字货币的趋势是必然的,而比特币只是其中一种形态,可能有更好的形态取代掉,那时可能就是一文不值。

第三,法律上还是模糊的,这就无端增加了监管的风险。在中国,应该是不合法的,偷偷摸摸的玩,风险更大。

Moreover, digital assets are currently considered indefinite-lived intangible assets under applicable accounting rules, meaning that any decrease in their fair values below our carrying values for such assets at any time subsequent to their acquisition will require us to recognize impairment charges, whereas we may make no upward revisions for any market price increases until a sale, which may adversely affect our operating results in any period in which such impairment occurs. Moreover, there is no guarantee that future changes in GAAP will not require us to change the way we account for digital assets held by us. Finally, as intangible assets without centralized issuers or governing bodies, digital assets have been, and may in the future be, subject to security breaches, cyberattacks or other malicious activities, as well as human errors or computer malfunctions that may result in the loss or destruction of private keys needed to access such assets. While we intend to take all reasonable measures to secure any digital assets, if such threats are realized or the measures or controls we create or implement to secure our digital assets fail, it could result in a partial or total misappropriation or loss of our digital assets, and our financial condition and operating results may be harmed.

此外,根据适用的会计准则,数字资产目前被视为无限期无形资产,这意味着在其收购后的任何时间,其公允价值低于我们的账面价值的任何降低都将要求我们确认减值准备,而我们可能在出售之前,不得对任何市场价格上涨进行上调,这可能会在发生减值的任何时期对我们的经营业绩产生不利影响。此外,我们无法保证GAAP的未来变化不会要求我们改变对我们持有的数字资产进行会计处理的方式。最后,由于数字资产是没有集中发行人或管理机构的无形资产,因此已经并且将来可能遭受安全漏洞,网络攻击或其他恶意活动,以及可能导致损失或损失的人为错误或计算机故障。销毁访问此类资产所需的私钥。尽管我们打算采取所有合理的措施来保护任何数字资产,但是,如果意识到这种威胁或者我们为保护数字资产而创建或实施的措施或控制措施失败,则可能导致部分或全部挪用或损失我们的数字资产,可能会损害我们的财务状况和经营成果。

会计准则这个,对个人投资者没啥风险。但安全漏洞,网络攻击,恶意活动,引起的私钥丢失,或是交易所问题,或是比特币的系统问题,却是需要担心的一个忧患。我一定要好好保护好自己的私钥,一旦被盗,哭天哭地都没有用,谁也帮不了。

In January 2021, we updated our investment policy to provide us with more flexibility to further diversify and maximize returns on our cash that is not required to maintain adequate operating liquidity. As part of the policy, we may invest a portion of such cash in certain specified alternative reserve assets. Thereafter, we invested an aggregate $1.50 billion in bitcoin under this policy. Moreover, we expect to begin accepting bitcoin as a form of payment for our products in the near future, subject to applicable laws and initially on a limited basis, which we may or may not liquidate upon receipt. Digital assets are considered indefinite-lived intangible assets under applicable accounting rules. Accordingly, any decrease in their fair values below our carrying values for such assets at any time subsequent to their acquisition will require us to recognize impairment charges, whereas we may make no upward revisions for any market price increases until a sale. As we currently intend to hold these assets long-term, these charges may negatively impact our profitability in the periods in which such impairments occur even if the overall market values of these assets increase.

2021年1月,我们更新了投资政策,为我们提供了更大的灵活性,以进一步分散和最大化现金的回报,而维持现金充足并不需要这些现金。作为政策的一部分,我们可能会将此类现金的一部分投资于某些特定的备用储备资产。此后,根据这项政策,我们总共投资了15亿美元的比特币。此外,我们希望在不久的将来,根据适用法律并在有限的基础上,开始接受比特币作为我们产品的付款方式,在收到付款后我们可能会或可能不会清算。根据适用的会计规则,数字资产被视为无限期无形资产。因此,购置后任何时间其公允价值低于我们这些资产账面价值的任何减少都将要求我们确认减值准备,而在出售之前,我们可能不会对任何市场价格上涨进行上调。由于我们目前打算长期持有这些资产,即使这些资产的整体市场价值增加,这些费用也可能在发生减值的期间对我们的盈利能力产生负面影响。

重复强调风险,主要还是公司的风险,对个人投资者来说,倒没什么。

In January 2021, we updated our investment policy to provide us with more flexibility to further diversify and maximize returns on our cash that is not required to maintain adequate operating liquidity. As part of the policy, we may invest a portion of such cash in certain specified alternative reserve assets. Thereafter, we invested an aggregate $1.50 billion in bitcoin under this policy. Moreover, we expect to begin accepting bitcoin as a form of payment for our products in the near future, subject to applicable laws and initially on a limited basis, which we may or may not liquidate upon receipt. We believe our bitcoin holdings are highly liquid. However, digital assets may be subject to volatile market prices, which may be unfavorable at the time when we want or need to liquidate them.

2021年1月,我们更新了投资政策,为我们提供了更大的灵活性,以进一步分散和最大化现金的回报,而维持现金充足并不需要这些现金。作为政策的一部分,我们可能会将此类现金的一部分投资于某些特定的备用储备资产。此后,根据这项政策,我们总共投资了15亿美元的比特币。此外,我们希望在不久的将来,根据适用法律并在有限的基础上,开始接受比特币作为我们产品的付款方式,在收到付款后我们可能会也可能不会清算。我们认为我们的比特币持有量很高。但是,数字资产可能会受到市场价格波动的影响,在我们想要或需要清算它们时,这可能是不利的。

法律风险,和清算时的价格风险。

In January 2021, we updated our investment policy to provide us with more flexibility to further diversify and maximize returns on our cash that is not required to maintain adequate operating liquidity. As part of the policy, we may invest a portion of such cash in certain specified alternative reserve assets. Thereafter, we invested an aggregate $1.50 billion in bitcoin under this policy. Moreover, we expect to begin accepting bitcoin as a form of payment for our products in the near future, subject to applicable laws and initially on a limited basis, which we may or may not liquidate upon receipt. We will account for digital assets as indefinite-lived intangible assets in accordance with ASC 350, Intangibles–Goodwill and Other. The digital assets are initially recorded at cost and are subsequently remeasured on the consolidated balance sheet at cost, net of any impairment losses incurred since acquisition. We will perform an analysis each quarter to identify impairment. If the carrying value of the digital asset exceeds the fair value based on the lowest price quoted in the active exchanges during the period, we will recognize an impairment loss equal to the difference in the consolidated statement of operations. The cost basis of the digital assets will not be adjusted upward for any subsequent increases in their quoted prices on the active exchanges. Gains (if any) will not be recorded until realized upon sale.

2021年1月,我们更新了投资政策,为我们提供了更大的灵活性,以进一步分散和最大化现金的回报,而维持现金充足并不需要这些现金。作为政策的一部分,我们可能会将此类现金的一部分投资于某些特定的备用储备资产。此后,根据这项政策,我们总共投资了15亿美元的比特币。此外,我们希望在不久的将来,根据适用法律并在有限的基础上,开始接受比特币作为我们产品的付款方式,在收到付款后我们可能会或可能不会清算。根据ASC 350,无形资产–商誉和其他规定,我们会将数字资产记为无限期无形资产。数字资产最初按成本入账,随后在成本(扣除自收购以来产生的任何减值损失)后在合并资产负债表上重新计量。我们将每季度进行一次分析以识别减值。如果该数字资产的账面价值超过了该期间活跃交易所报价的最低价格的公允价值,我们将在合并经营报表中确认减值损失。数字资产的成本基础将不会随着活跃交易所中其报价的后续增加而向上调整。除非有变现,否则收益将不会被记录。

Tesla 会持续的分析和买卖,如果我跟着玩,我能做到吗?如果我不能做到,Tesla又不会告诉我啥时买卖,那么,我必定会成为最后接棒的韭菜,赚不明白,亏也不明白。跟风,从众,不自己去努力,一定不会有好结果。

好了,分析了这么多,我怎么配和首富一起玩呢?

如果有闲钱,理解了风险,心安,作为一种资产,可以去尝试一下,不要抱着暴富的心态,长期持有,也许才是一种配玩的策略。

待字闺中

微信号:daiziguizhongren

深度分析大数据、深度学习、人工智能、区块链等技术,切中实际应用场景,为大家授业解惑。

区块链神吐槽

区块链神吐槽